尽管亚欧和跨太平洋贸易航线上的集装箱现货价格似乎已跌至谷底,但许多新的长期合同的开始签订日期仍不确定。由于合同谈判陷入僵局、需求疲软,托运人、BCO和无船承运人正将更高比例的业务转向现货市场。

事实上,船公司正在积极鼓励他们的合同客户通过现货价格订舱,而不是把货物拱手让给竞争对手然后再回头争取客户。

最新一期波罗的海运价指数(FBX),亚洲至北欧指数持平,平均为每40英尺1349美元。很明显,船公司准备在运力管理方面取一切措施防止该航线的运价跌破1000美元。亚洲至美西的FBX指数也保持稳定,运价为1006美元/FEU,而美东在前几周录得亏损后运价稳定在2100美元/FEU。

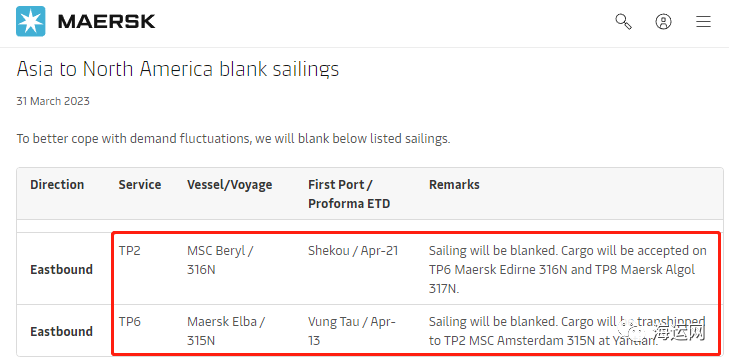

跨太平洋航线船公司公司正在加紧实施“空白航行”计划,以减轻需求减少的影响和运费进一步下降的压力,最近,2M联盟的合作伙伴马士基和MSC于31日宣布取消分别于4月13日和21日从中国出发的TP6/Pearl和TP2/Jaguar两个航次。

TP6/Pearl和TP2/Jaguar停航

TP2航线

TP6航线

事实上,航线货量低迷,未来前景迷惘,船公司为缓解需求极度疲软的影响、遏制集装箱即期运费下滑而采取的取消航次策略显然也没有取得成效。2月13日,马士基宣布,由于预测全球需求减少,决定采取措施平衡服务网络,因此将暂停跨太平洋TP20钟摆航线,直至另行通知。3月中旬,2M联盟宣布永久停止运营其6条亚欧航线之一的AE1/Shogun环线。

与此同时,Xeneta的3月份的长期运价分析显示,在自去年8月以来下跌了四分之一之后,该运费基准公司的指数在其众包数据中仅下降了0.5%。

Xeneta首席执行官Patrik Berglund解释说,这并不意味着班轮市场出现了反弹,而是由于缺乏来自托运人客户的新合同数据。他解释说:“降幅相对较小的主要原因是缺乏新的有效合同,而不是基本面有所加强。欧洲的主要招标季节已经过去,而美线市场的招标季即将到来。至少可以这么说,船公司维持目前长期合同运价的前景看起来很渺茫。

Berglund表示,预计未来几个月新合同费率将“大幅下降”,这反过来将大幅拉低XSI指数。他补充道:“除非发生重大事件,否则我认为下半年的长期合同将与2023年初的有效合同大不相同。”

在其他航线,跨大西洋航线集装箱现货运价继续周环比下跌,Xeneta的XSI北欧至美东指数显示运价在过去7天内再次下跌8%至3975美元/FEU。

此外,据一位北大西洋航运公司贸易经理消息,事实上市场价格已经跌破3000美元。该经理表示:“预计在6月之前,运费价格将跌回到每箱2000美元。”

来源:宁波航运