日本海洋网联船务(ONE)在4月28日公布了2022财年(即2022年4月1日至2023年3月30日)业绩。

2022财年全年,即2022年4月1日至2023年3月30日,ONE实现营业收入292.82亿美元,同比下降2.7%;息税前利润(EBIT)为163.20亿美元,同比下降10.7%;息税折旧摊销前利润(EBITDA)达到150.05亿美元,同比下降12.7%;净利为149.97亿美元,同比下降10.5%。2022财年全年载箱量达到1108.1万TEU,同比下降8.1%。

2022财年第四季度,即2023年1月1日至3月30日,ONE实现营业收入46.42亿美元,同比下降44.3%;息税前利润为11.84亿美元,同比下降77.3%;EBITDA为15.58亿美元,同比下降70.5%;净利为12.10亿美元,同比下降76.3%。

ONE表示,2022财年全年净利同比减少17.59亿美元。强劲的集运市场在上半财年持续,但在下半年,由于全球经济放缓和港口拥堵的缓解,运力供给恢复,与在同时,在美国商品库存高企、欧洲通胀上升导致消费下降的背景下,全球需求急剧下降,并且今年一季度集运市场需求下降变得更加明显,市场运价迅速走弱。

货量方面,今年一季度载箱量达到259.6万TEU,同比下降8.5%。其中,亚洲-北美东行航线载箱量为46.8万TEU,同比下降10.5%,舱位利用率90%;亚洲-欧洲西行航线载箱量为34.6万TEU,同比下降18.0%,舱位利用率达到95%;亚洲-北美西行航线载箱量为29.4万TEU,同比增长22.5%,舱位利用率55%;亚洲-欧洲东行航线载箱量为23.5万TEU,舱位利用率54%。

总的来说,ONE今年一季度的表现与行业趋势一致,但仍超出市场预期。此前,ONE预计2022财年第四季度税后净利润预估为9.4亿美元,实际结果达到12.10亿美元。与此同时,尽管需求疲软,ONE在两条主要的贸易航线上的船舶利用率同比大幅下降,环比均有所提高。亚洲-北美东行的舱位利用率从去年四季度的80%提高到90%,西行的舱位利用率从49%提高到55%。亚洲-欧洲西行的航位利用率从90%提高到95%,东行则保持稳定在54%。

ONE首席执行官Jeremy Nixon表示,与前两年的第一季度(即2021年和2022年第一季度)相比,今年一季度集运市场需求明显疲软。这并不完全出乎意料,因为2022疫情后在美国商品库存高企、欧洲通胀上升导致消费下降。最近的销售和库存水平出现了不利变化,尤其是在北美和欧洲。由于需求的收缩,一些从亚洲出发的东西向主要路线的出口航次不得不减少。就复苏而言,亚洲区域内和南北路线的贸易量总体上更具弹性。从订舱情况来看,除中国港口外,其他航线订舱情况略有改善,但这很可能是由于5月初的黄金周。可能至少要“熬”到6月和7月份才能看到任何明显改善的迹象。在运力供给方面,去年爆发的全球港口和内陆拥堵现已基本消散,运力供给恢复。然而,在美西港口,去年太平洋海事协会(PMA)和国际码头和仓库联盟(ILWU)之间的劳工协议尚未最终确定。此外,由于在2021/2年高峰期续签的租船合同租期普遍较长且尚未到期,可供租用的吨位仍然比预期更紧。

ONE的投资与应对措施

当前集运市场正处于变化之中,ONE正在调整适应这些重大变化,采取包括空白航行期延长等措施,旨在提高盈利能力并降低营运成本。

正如航运界网的跟踪报道,随着集运市场进一步走低,在经营为王,控制成本的策略下,以ONE为代表的班轮公司在亚洲-欧洲东行和亚洲-北美东的回程航次中,纷纷选择绕航好望角来避开苏伊士运河与巴拿马运河的高昂过河费。此外,还通过降速航行减少燃料消耗。

根据ONE的中期计划,将继续谨慎管理资产负债表,并在必要时进行战略投资。3月份,ONE确认已下单订造10艘13700TEU集装箱船,将于2025年和2026年交付。ONE还宣布计划收购美西三个集装箱码头(YTI/LA、Trapac-LA和Trapac/Okland)的多数股权。此外,ONE收购Seaspan母公司Atlas的少数股权。与此同时,作为不断升级和扩大全球设备的努力的一部分,宣布购买新的冷藏车和特种货物部门。ONE还致力于用远程信息处理物联网实时跟踪器升级冷藏箱,并与索尼达成了新的战略合作,为其全球干货箱开发集成智能集装箱跟踪解决方案。

绿色战略:ONE首次推出二氧化碳计算工具

国际海事组织(IMO)将于6月在伦敦举行MEPC 80会议,ONE希望这次会议将带来更长期、更雄心勃勃的可持续发展目标和燃料标准法规。与此同时,ONE正在进一步减少排放,并开发未来的绿色燃料和碳捕获技术解决方案的基础上,推进其不断发展的脱碳战略。此外,ONE将继续促进在可持续性、最佳实践共享以及通用技术和报告标准方面的泛行业合作。ONE最近还推出了“ONE Eco Calculator”计算工具,可以提供从收货地到目的地,包括船舶、设备、港口到港口和内陆运输在内的全程二氧化碳排放量。

提升服务水平:

ONE正专注于通过其新的云服务系统升级和提高全球客户服务水平。可以更快、更全面地满足托运人和收货人的服务需求。除了继续增强“实时聊天”功能外,还进一步升级了“ONE QUOTE”服务,以简化在线自助订舱流程。此外,ONE还宣布积极促进电子提单在行业内的更广泛使用。

此外,ONE还持续扩大港口覆盖范围,提前在东西航线中部署更大的船舶,并向南北航线和大西洋航线部署额外运力,相继宣布升级缅甸、菲律宾南部、巴林、科威特、秘鲁、智利、以色列和埃及等支线服务。

ONE增加非洲、印度和中东(AIM)航线的班次

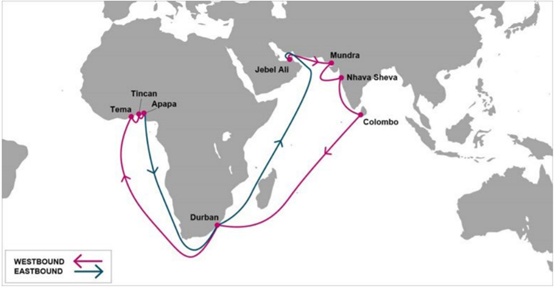

4月19日,ONE宣布,从2023年5月起,非洲、印度和中东(AIM)服务将从每两周一班增加到每周一班。这是ONE致力于加强非洲航线的一部分。

港序保持不变:Jebel Ali-Mundra-Nhava Sheva-Colombo-Durban-Tema-Tincan-Apapa-Durban–Jebel Ali(周班)

将从2023年5月6日从Jebel Ali西行和2023年6月9日从Tema出发的东行船次开始执行。

ONE进一步加强了新加坡与菲律宾的联系

4月20日,ONE宣布将更新PHX2航线的港序。更新后的港序:新加坡-马尼拉-宿雾(CEBU)-新加坡。

ONE表示,该航线将以两周一班的班次运行。目前,ONE将能够通过PHX、PHX2、PHX3三条航线,从新加坡向菲律宾提供更快速、可靠和高效的运输方案:PHX:新加坡-苏比克、马尼拉;PHX2:新加坡-马尼拉-宿务;PHX3:新加坡-达沃-桑托斯将军城。

ONE推出连接阿联酋和巴林/科威特的新航线(UGS)

ONE宣布推出一条连接阿联酋和巴林/科威特的新航线。UGS航线提供从转运中心杰贝阿里到广阔的阿拉伯半岛门户的更快、高效和更稳定的连接。

港序B:Jebel Ali (JEA) – Shuaiba (SAA) – Shuwaikh (SWK) – Jebel Ali (JEA),每8-10天一班

ONE推出新加坡至仰光航线

3月20日,ONE推出新加坡至仰光航线“SMM”。新航线将合并原有的“YGX”和“TMM”航线服务,合并升级为每周两班。港序:Singapore – Yangon (MIP) – Singapore – Yangon (AWPT) - Singapore

来源:航运界