赫伯罗特(Hapag-Lloyd)发布2023年第一季度未经审计的财报。

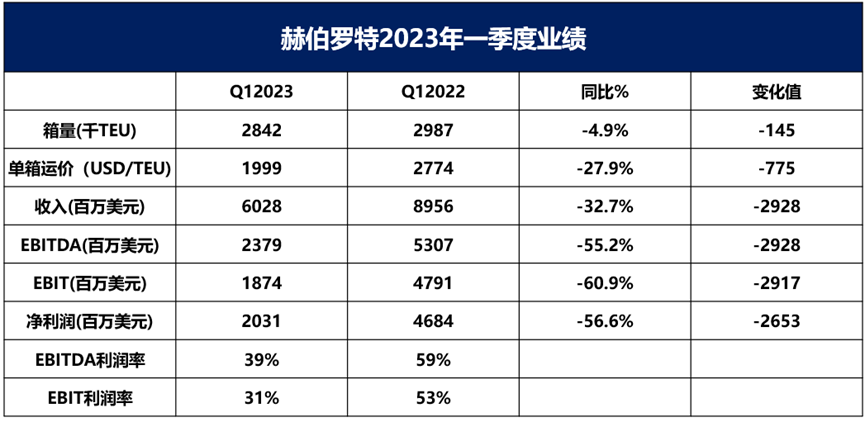

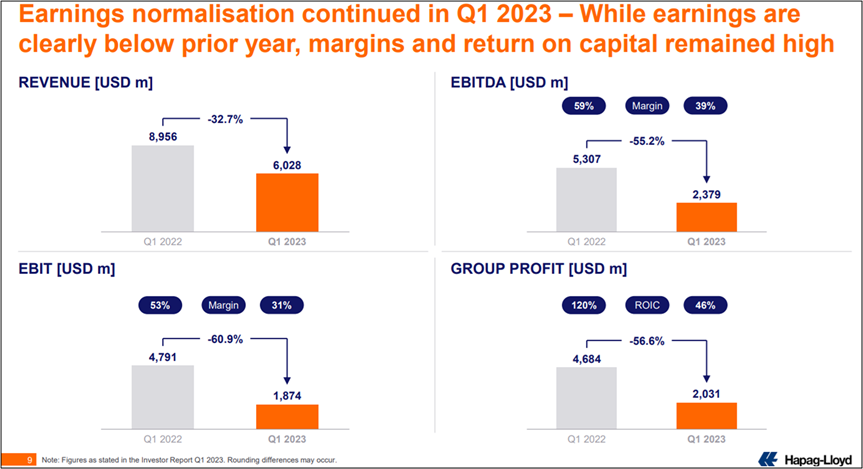

2023年一季度,赫伯罗特承运箱量达284.2万TEU,同比减少14.5万TEU或4.9%;平均单箱运费1999美元,同比下降775美元或减少27.9%;实现营业收入56.19亿欧元(60.28亿美元),同比减少32.7%;息税折旧摊销前利润(EBITDA)为22.17亿欧元(23.79亿美元),同比减少55.2%;息税前利润(EBIT)达到17.47亿欧元(18.74亿美元),同比减少60.9%;净利润达到18.93亿欧元(20.31亿美元),同比减少56.6%。2023年一季度EBITDA利润率达到39%,EBIT利润率达到31%。

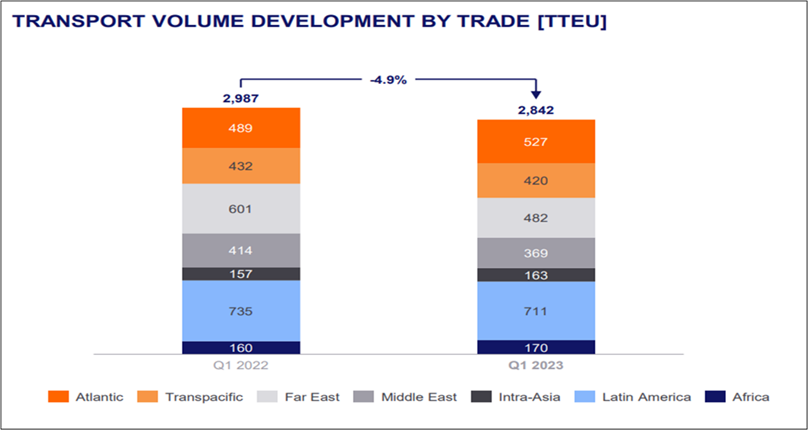

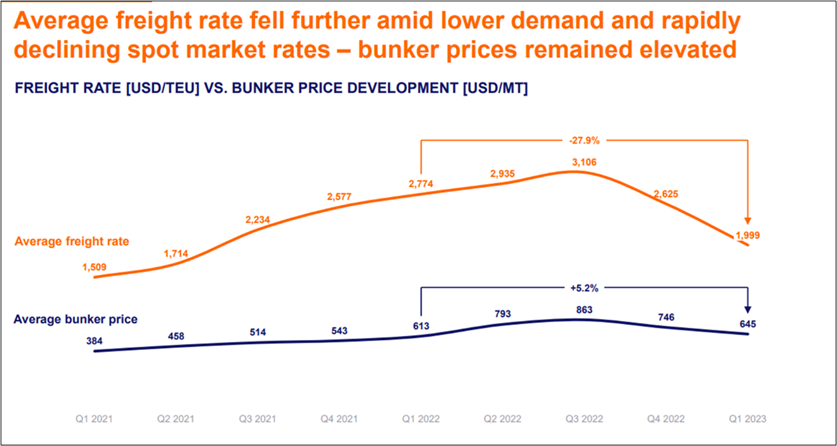

赫伯罗特表示,由于零售商去库存和全球整体需求疲软,承运箱量同比下降4.9%,此外,平均单箱运费同比下降27.9%,这是营收下降的主要原因。运输成本则保持在与去年同期相当的水平,即33亿美元,承运箱量下降伴随着通货膨胀导致的相关成本增加和燃料价格的上涨,今年一季度平均燃料成本为645美元/吨,而去年同期为613美元/吨。

赫伯罗特表现出超过同行的韧性

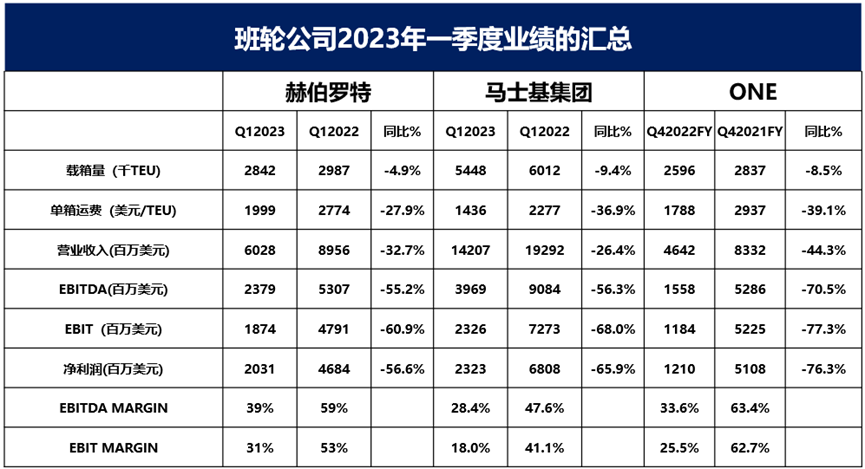

就载箱量的角度而言,2023年第一季度,赫伯罗特同比下降4.9%,而马士基同比下降9.4%,海洋网联船务(ONE)同比下降8.5%,东方海外同比下降3.2%。

就营业收入而言,2023年第一季度,赫伯罗特营收同比下降32.7%,马士基同比下降26.4%,ONE则同比下降44.3%,东方海外同比下降57.8%。

就单箱平均运费而言,一季度,赫伯罗特单箱平均运费在1999美元,马士基、ONE单箱平均运费分别为1436美元、17882美元。

就净利而言,2023年一季度,赫伯罗特净利润同比下降56.6%,而马士基同比下降65.9%,ONE同比下降76.3%。

2023年业绩预期,也展现出更强的韧性,正常化到比2020年略好的水平

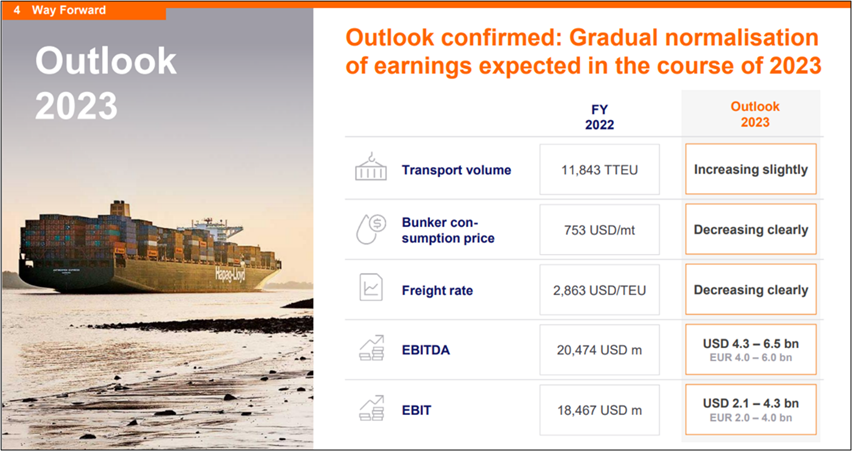

赫伯罗特维持3月2日发布的业绩预期,2023财年的盈利趋势将逐步正常化。息税折旧摊销前利润预计在43至65亿美元(40至60亿欧元)之间,息税前利润预计在21至43亿美元(20至40亿欧元)。然而,鉴于俄乌持续的冲突、其他地缘政治不确定性和持续的通胀压力的影响,可能会对预测产生负面影响。

赫伯罗特首席执行官Rolf Habben Jansen表示,“尽管业绩有所下降,但赫伯罗特在本财年取得了稳健的开局。市场环境已经正常化,需求和运费也相应下降。这无疑会对我们全年的收益产生影响,因此赫伯罗特将密切关注成本。此外,赫伯罗特正在制定进一步发展战略。“

根据Alphaliner最新数据,赫伯罗特在全球班轮公司运力100强中排名第5,共运营248艘船,总运力180万TEU,其中自有船舶120艘、租入船舶128艘。同时,赫伯罗特手持17艘新造船订单,约34.9TEU。

来源:航运界