由于市场需求低迷,ZIM正在通过卸载多艘租赁船舶来减少其在货运市场的风险敞口。

最近有报道称,Zim提前终止了7艘包租船以及两艘转租船的租船协议,两份早期的租船终止合同得到了船东的确认。

据了解,希腊集装箱船船东Euroseas终止了Rena P轮和Emmanuel P轮与ZIM的现有租约,同时为这些船只签订了新的租约。

2007年建造的4250 Teu的Rena P轮的现行租约原定于2025年2月到期,在2024年4月之前,每天的租金为20250美元,随后,根据ConTex指数,最低租金为13000美元,最高租金为21000美元;2005年建造的4500 Teu 的Emmanuel P轮的现行租约原定于2025年3月到期,日租金19000美元。

但是,Euroseas同意终止这两艘船的租约,并签订了一份最短20至最长24个月的定期租船合同,日租金为21000美元。新租约将于2023年8月在现行章程终止后生效。

船舶经纪公司Banchero Costa和Braemar表示,这两艘船重新租给了东方海外(OOCL)。

Euroseas首席执行官Aristides Pittas表示:“与终止的包租合同相比,新的包租合同预计将带来200万至400万美元的额外收入。”

Braemar报告称,Zim将采取进一步措施,通过转租租赁船舶来减少其市场风险。

该公司表示,总部位于丹麦的马士基已以每天3.65万美元的价格租用6078标箱的Zim Pusan轮,租期为两至五个月。

此外,Zim还从Costamare租赁了4,258 Teu 的Volans轮,租期至2024年4月,日租金24,250美元。根据Braemar的说法,这艘船刚以每天21,750美元的价格租给了德国船公司赫伯罗特,从8月开始租期为11-14个月。

此外,Tradewinds援引欧洲经纪人消息称,4250标准箱的Zim Vancouver轮, Zim Shekou轮, Zim Yokohama轮和 Zim Qingdao轮正被目前的船东Chartworld出售给世界最大的海运公司瑞士MSC,在此过程中,Zim Qingdao轮的租约被解除。

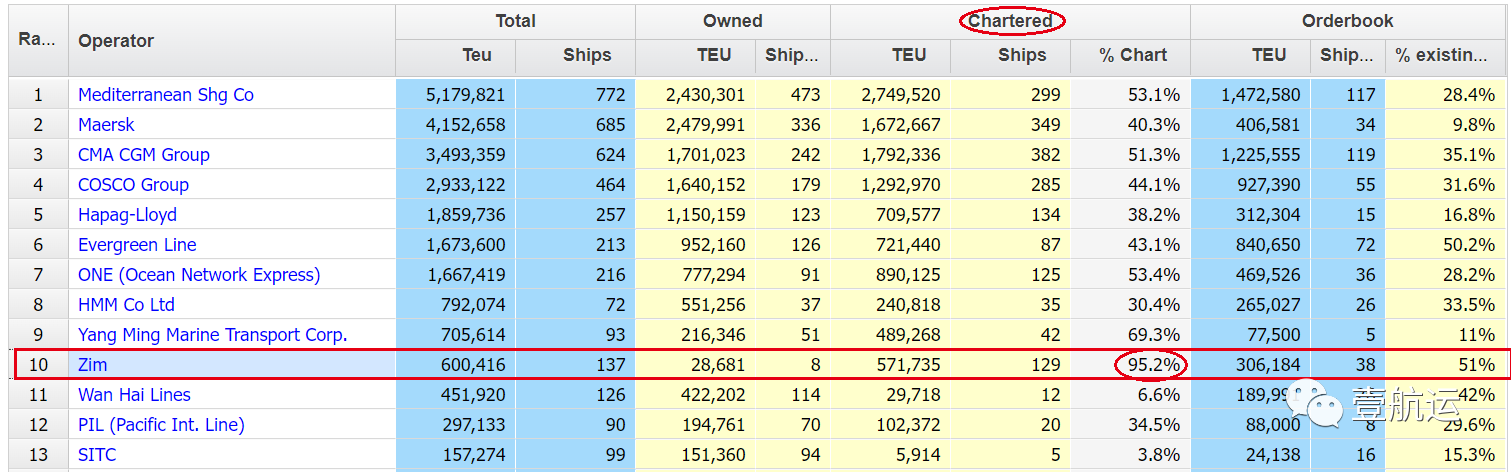

Zim是全球第十大船公司,与其他航运公司不同,它租赁了90%以上的船队,而大多数船公司拥有大约一半的自有船队。

截至今年5月,Zim运营着138艘集装箱船,其中17艘将于今年续约,27艘将于明年续约,而同期计划交付的新船为40艘。除了让租约如期到期外,提前终止和转租还使Zim能够抵消新造船能力和弱于预期的需求的影响。

7月12日,Zim大幅下调了2023年全年的盈利预期。ZIM首席执行官Eli Glickman表示:“我们不再预计2023年下半年运费会有所改善,这与之前假设的季节性相符。”

“在经济低迷时期,我们将继续积极管理和合理化我们的船队和服务,以最大限度地提高我们的现金状况。”

来源:壹航运