达飞第二季度物流业务营业收入为38亿美元;EBITDA为3.56亿美元,同比增长4.7%。

达飞7月28日公布2023年第二季度业绩。

尽管第二季度的运输需求相比第一季度有所反弹,且能源价格处于低位,但第二季度航运物流市场仍较为低迷。

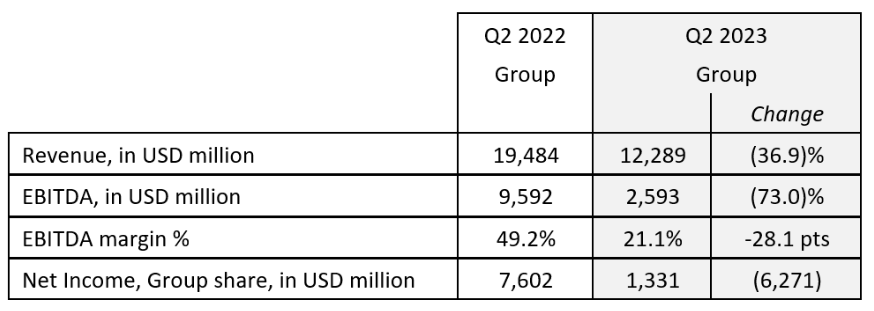

报告期内,达飞实现营业收入123亿美元,主要由航运业务推动,同比下降37%;息税折旧摊销前利润(EBITDA)为26亿美元,同比下降73%;净利润为13亿美元,同比下降83%。

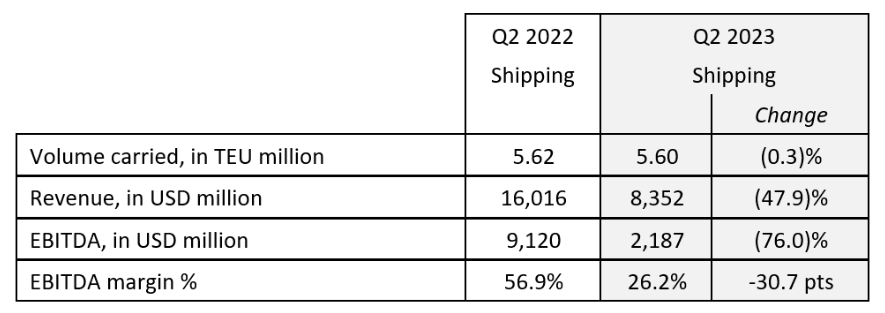

其中,航运业务实现营业收入84亿美元,同比下降48%;EBITDA为22亿美元,同比下降76%。平均运费为1491美元/TEU,同比下降10%。

货量方面,达飞表示,南北航线的货量较为旺盛,但跨太平洋和亚欧航线货量受家庭消费支出减少影响,持续低迷。第二季度,达飞货运量为560万TEU,同比微跌0.3%,不过与第一季度相比,货量反弹了近12%,这反映出航运业的季节性特征和需求的回升。

物流业务方面,实现营业收入38亿美元,与上年同期持平;EBITDA为3.56亿美元,同比增长约5%。

对此达飞分析称,在全球贸易下滑的背景下,物流业务业绩稳定,既反映了货运市场下滑,也说明自2022年第二季度开始,达飞在物流领域的多项收购,加强了为客户提供端到端供应链服务的能力。

达飞集团董事长兼首席执行官Rodolphe Saadé评价业绩称:“正如预期的那样,航运业在第二季度继续趋于正常,尽管市场环境艰难,但我们的业绩表现仍然强劲。近几年,我们大大加强了航运和物流两大战略支柱业务。在此基础上,我们将继续转型,整合最近收购的子公司,同时加大投资力度。”

达飞还强调,其在能源转型方面继续投资。将投资超过140亿美元,拥有100多艘液化天然气和甲醇动力集装箱船,实现能源结构多样化,目标是到2050年实现净零碳排放。此外,通过设立达飞能源基金,加速海、陆、空及物流业务的能源转型。

展望2023年下半年,达飞认为,宏观经济和地缘政治仍充满不确定性,航运物流市场充满挑战。下半年全球经济增长依旧缓慢,同时航运市场新投入运力增加,可能会拖累运费,特别是在东西向航线上。

不过达飞仍对抵御市场波动充满信心,并强调会特别注意控制营运成本。

来源:中国航务周刊