韩国海关总署数据显示,一季度出口同比下降12.6%,至1515亿美元。出口大幅下降的主要原因是芯片出口减少。这是自2020年第二季度以来最糟糕的数据。从单月看,韩国出口金额单月同比已连续6个月为负,今年3月更是高达-13.6%。按工作日调整后出口同比增速为-16.6%,2月为-15.9%。

据中新经纬援引韩国国际广播电台报道,韩国出口持续衰退。贸易收支连续第13个月出现逆差,逆差幅度为46.2亿美元。

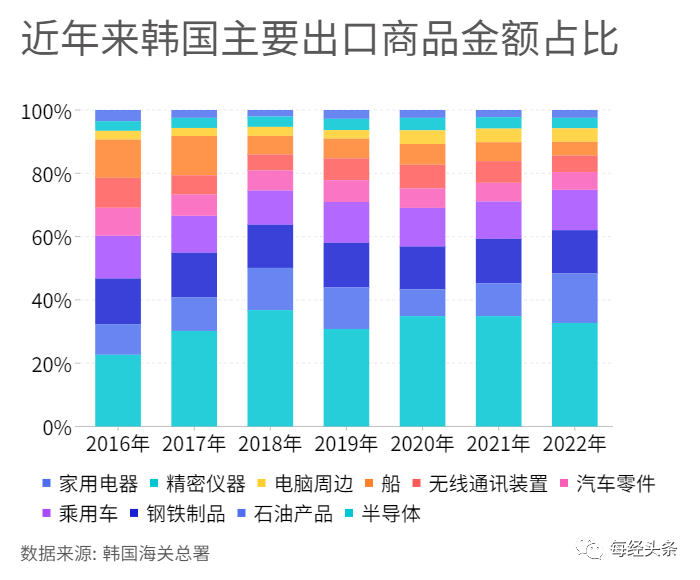

分产品看,半导体出口增速边际改善但跌幅仍深,计算机、手机等电子设备的出口低迷,汽车表现较为亮眼。

韩国最重要的出口品类为半导体。据韩国海关总署数据,2022年半导体出口金额1321.46亿美元,占韩国出口总金额的32.7%。3月半导体出口持续低迷,同比下降33.85%。电脑周边3月出口同比下降56.53%。无线通讯装置出口同比下滑40.33%。只有汽车出口韧性较强,3月出口同比增长65.7%。

韩国开发研究院认为,3月出口同比减少13.6%,较2月(-7.5%)的减幅进一步拉大。由于半导体等主要品目出口持续乏力,制造业高库存、低开工的局面将持续,生产出现大幅减少。

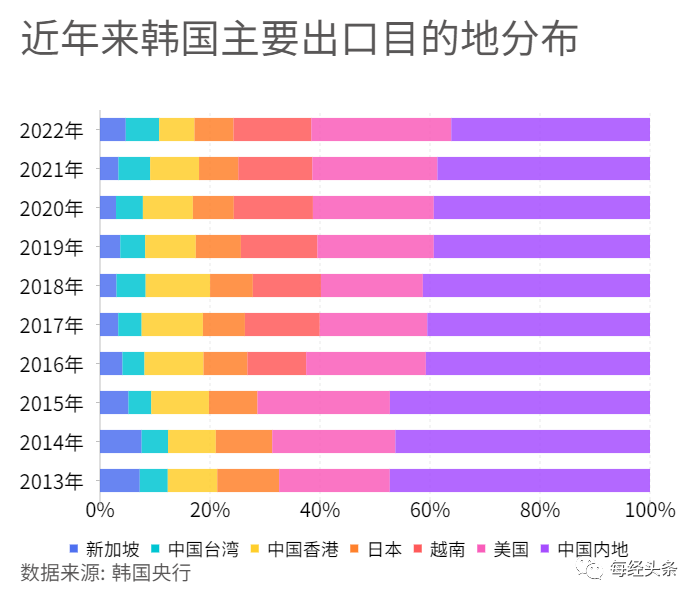

按出口目的地来看,,韩国对中国出口未明显好转,对美欧出口增速也进一步回落。3月韩国对中国的出口同比下降33.4%,较1-2月平均增速进一步下降5.5个百分点。

作为韩国最大出口对象(2021年约占韩国总出口的26%),3月韩国对中国出口拖累韩国整体出口约8.2个百分点。同期,韩国对美欧出口也进一步下滑。

3月韩国对美国和欧盟出口同比分别录得1.6%和-1.1%,较1-2月的4.5%和6.9%分别下滑2.9个百分点和8.0个百分点,反映美欧商品消费需求有所回落。新兴市场方面,韩国对东盟的3月出口为-20.1%,持续低迷。

今年2月,韩国贸易协会在“出口低迷原因分析和应对方向”说明会上表示,考虑到出口降幅,韩国出口低迷相对更加严重。韩国贸易协会副会长郑晚基在当天的说明会上表示,这主要是因为韩国出口产业由对经济变动敏感的中间产品为主的产品群构成。近年来,韩国出口商品中,半导体、石油产品、钢铁制品、乘用车等占据较大份额,且结构多年来没有太大变化,应对风险或变化的能力有限。

韩国贸易协会预测,上半年出口低迷现象将持续。因为上半年世界经济仍处于下滑趋势,贸易量恢复有限。以中间产品为主的韩国出口在每次经济危机时都会比世界贸易的趋势涨跌幅度更大,因此今年中国经济恢复力、俄乌战争事态是否平息等外部条件的变化也会使韩国出口呈现出弹性恢复趋势。

来源:中货协