独立集装箱船东MPC Container Ships ASA (以下简称“MPCC”或该公司)5月23日发布2023年第一季度未经审计的财报。

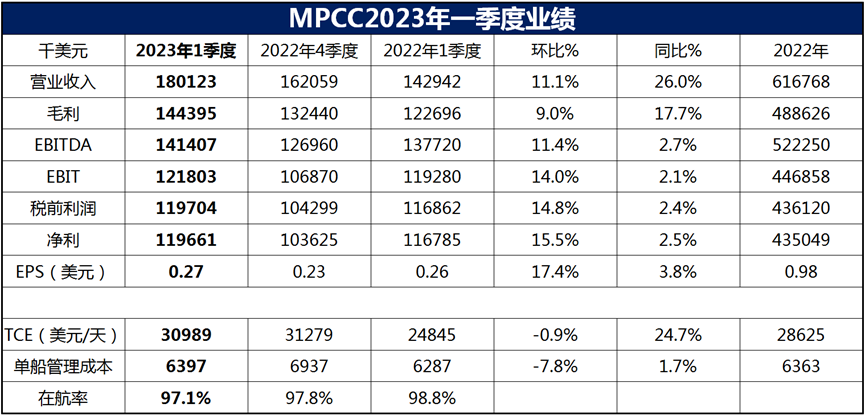

2023年一季度,MPCC实现营业收入1.8亿美元,同比增长26.0%,环比增长11.1%;毛利达到1.4亿美元,同比增长17.7%,环比增长9.0%;息税折旧摊销前利润(EBITDA)达到1.4亿美元,同比增长2.7%,环比增长11.4%;息税前利润(EBIT)为1.2亿美元,同比增长2.1%,环比增长14.0%;税前净利为1.2亿美元,同比增长2.4%,环比增长14.8%;净利润达到1.2亿美元或每股盈利0.27美元,同比增长2.5%,环比增长15.5%。

2023年一季度,MPCC船队日均TCE达到30989美元,同比增长24.7%,环比减少0.9%;单船日均管理成本为6397美元,同比增加1.7%,环比下降7.8%。航队在航率达到97.1%,略低于去年同期的98.8%。

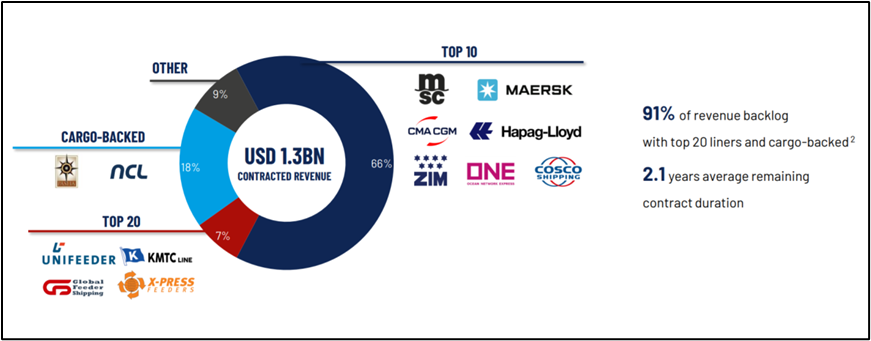

MPCC首席执行官Constantin Baack表示,很高兴报告另一个强劲的季度业绩,尽管存在持续的宏观和地缘政治不确定性,但仍有强劲的盈利和持续的高船队利用率。这是由坚实的租船合同和持续强劲的运营业绩所推动。截至一季度末,MPCC2023年和2024年的租约覆盖率分别达到了89%和58%,这为MPCC提供了未来几年现金流和分红能力的可见性。2023年租船合同累计租金储备达到13亿美元。

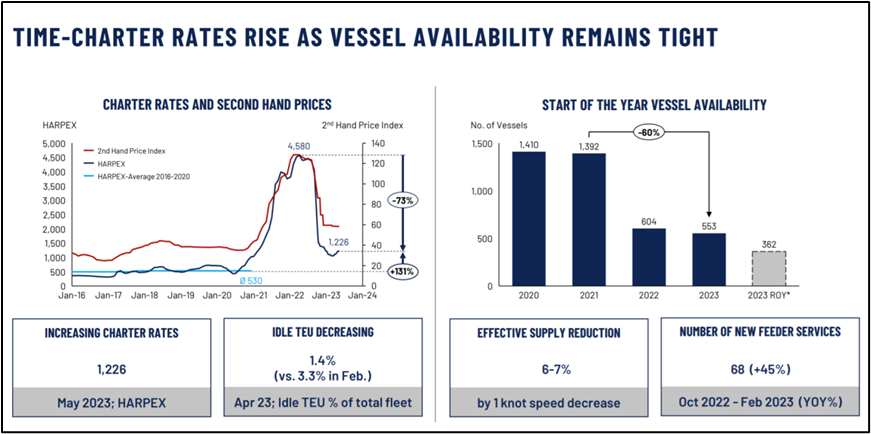

在2022年下半年和2023年初经历了急剧的市场正常化之后,集装箱船租船市场现在显示出企稳的迹象,而且租金水平远高于历史平均水平。目前的租金企稳将受到可供租用船舶的制约,如降速航行等。特别是对于区域航线,与大型船舶相比,支线船舶的供需平衡更令人鼓舞,需求超过了运力增长,并且有合理的船舶拆解的支持。尽管如此,大型船舶的供应增长将如何影响未来的整体集装箱市场,还有待观察。

2023年业绩预期

MPCC管理层维持2023年业绩预期,预计全年营业收入达到6.1-6.3亿美元,EBITDA达到4.2-4.5亿美元,包括2022年12月和2023年1月宣布的出售“AS Cleopatra”轮和“AS Carintia”轮的预期收益,以及2023年1月收到的“AS Carlotta”提前还船的和解款项。

具体而言,MPCC与其合资伙伴已同意以760万美元的价格出售“AS Carintia”轮(2003年建造,2800 TEU)。此外,MPCC还宣布以3390万美元的价格收购了“RIO CENTAURUS”轮(2010年建造,3400TEU)和“TRF KAYA”轮(2007年建造,2800TEU)。这2艘船都安装了脱硫塔,并附带有租约,分别将于在2023年第4季度和2024年第1季度到期。

截至目前,MPCC拥有并运营62艘集装箱船,总舱位134700EU。此外,MPCC还手持4艘新造船订单,这些船都附有租船合同。2艘5550TEU新造船订单,每艘造价7220万美元,预计2024年第一季度交付。2022年7月,MPCC斥资7800万美元在泰州三福订造2艘甲醇动力1300TEU集装箱船,预计2024年第三、四季度交付。

Constantin Baack总结道,基于合同现金流的高可见度和稳健灵活的资产负债表,MPCC处于持续创造价值的理想位置,并继续致力于将资本返还给股东的政策。今年一季度,MPCC将利用灵活的商业模式和财务灵活性,并将继续专注于持续优化船队。展望未来,MPCC将继续努力,并将继续专注于持续优化船队,以实现股东的最大利益,并促进行业脱碳。

来源:航运界