航运分析师表示,如果今年集运旺季与美西劳工谈判和巴拿马运河的干旱持续同时发生,跨太平洋航线现货运价将进一步上涨,并缓解集运市场运力过剩问题。

Descartes数据显示,由于从中国和越南的进口增加,美国5月份集装箱进口量比2023年4月有所增加,与2018-2019年疫情前的进口量季节性保持一致。特别值得关注的是,船舶在港时间在增加,并已恢复到2023年初的水平;美西港口劳工谈判再起波澜,工会活动增多导致港口运营中断;巴拿马运河吃水下降正在影响亚洲至美东和美湾的运输。如果上述情况持续存在,再加上有迹象表明今年的旺季很有可能会遵循传统规律,全球供应链可能会面临更复杂的挑战。

美国进口箱量上升

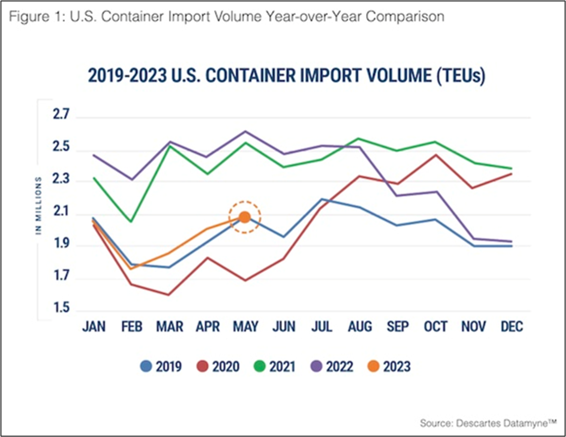

根据Descartes数据,2023年5月,美国集装箱进口量较4月环比增长3.8%,达到2,097,313TEU(见图 1)。与2022 年5月相比,则同比下降了20.0%,但比疫情前的2019年5月增长了0.5%。

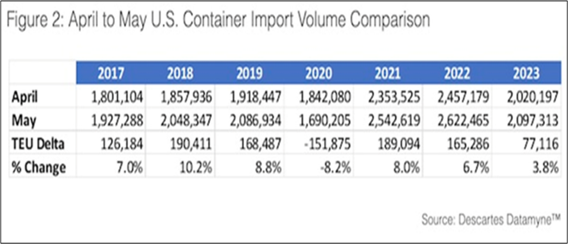

Descartes数据显示,比较过往6年的3月至4月进口量的增幅,2023年4月的进口量较同年3月出现代表性增长(见图2)。

对于排名前 10位的美国港口,2023年5月美国集装箱进口总量较4月份增加了68,742TEU(见图 3)。洛杉矶港的集装箱总吞吐量增量最大,达到56,226TEU,塔科马港的增幅最大,达到 33.3%。

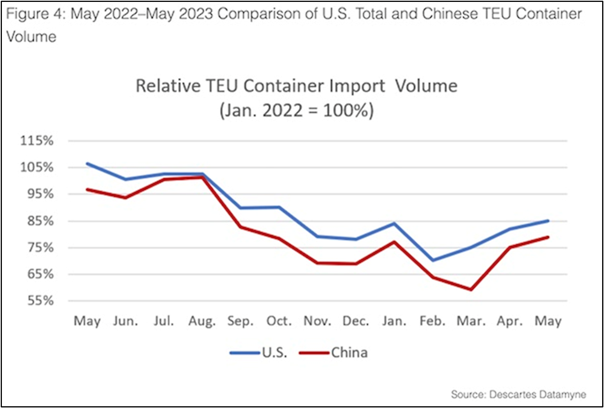

2023年5月,美国从中国的进口集装箱量已经连续第二个月增长,比2023年4月增长5.1%,达到780684TEU,但仍比2022年8月的高点低约22.2%。(见图 4)。

5月份,从中国进口的集装箱占美国集装箱进口总额的37.2%,比4月份增长0.4%,但仍比2022年2月的41.5%的高点下降4.3%。

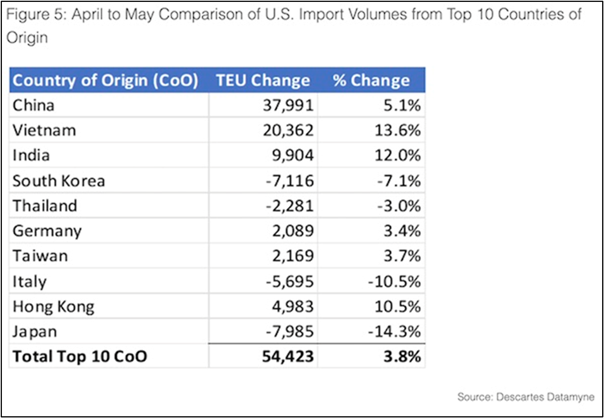

在前10大出口国中,2023年5月美国集装箱进口量增长3.8%或54423TEU,其中从中国进口的整体增长最大达37991TEU或5.1%,越南增幅比例最大,为 13.6%或增加20362TEU(见图 5)。日本的降幅最大(-14.3%),这主要是由于 5 月前五天的黄金周假期的影响。

美西主要港口市场份额持续增长

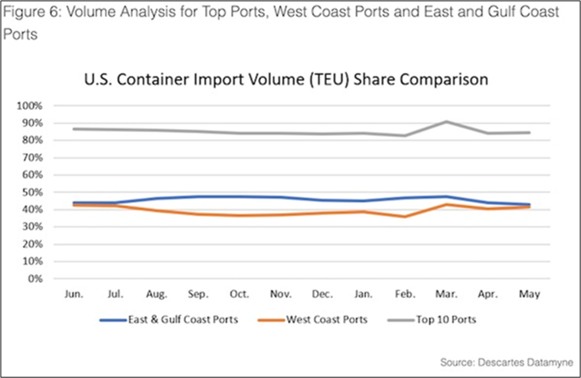

2023年5月,美西主要港口市场份额再次增长,美东和美湾主要港口的市场份额则有所下降。

与2023年4月相比,美西前五大港口市场份额增加到 41.5%(增长 1.3%),美东和美湾前五大港口市场份额下降至 42.8%(下降 1.2%)。与较小的港口相比,2023年5月前10大港口的份额稳定在84.3%,与2023年4 月的基本相同(见图 6)。

港口拥堵可能会逆转并蔓延至主要港口

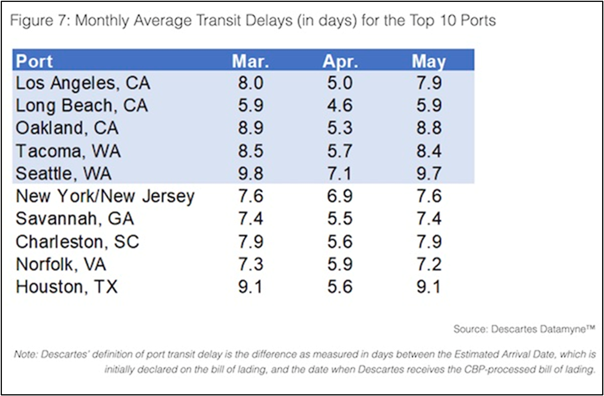

与2023年4月相比(见图 7),2023年5月的总体港口作业延误时间要长得多,总体上与 2022 年底和 2023 年第一季度的延误情况相似。

美西港口劳工谈判进展缓慢

就在集运市场快速正常化,运价仍然面临压力的关键时刻,美西港口劳工谈判升级和巴拿马运河水位下降可能会导致新一轮供应链中断,这可能导致运价上涨,并缓解集装箱行业的一些产能过剩问题。

航运分析师、咨询公司Vespucci Maritime创始人Lars Jensen表示:“这对进口商和出口商来说肯定是一个不利因素,但对班轮公司来说实际上并不是一件坏事。”

虽然这对全球供应链来说是个坏消息,但对于面临运力过剩的班轮公司而言,这真是一件意外的礼物。

Xeneta首席分析师Peter Sand补充道:“对货主而言非常不利,他们应该预计货物运输时间会增加,而且运价会飙升,但这个时机对班轮公司来说是完美的。”

赫伯罗特首席执行官Rolf Habben Jansen本周表示:“我希望劳工谈判很快结束,因为旺季将至,如果出现动荡将有损各方利益。”

美国全国零售联合会(NRF)供应链副总裁Jonathan Gold表示:“如果工会和港口管理层无法达成协议,码头将无法高效运营,零售商将别无选择,只能继续将货物运往美东和美湾沿岸港口。”

巴拿马运河水位下降给美东和美湾的航线带来压力

与此同时,将货物运往美东和美湾沿岸港口也存在问题,因为巴拿马正经历自1950年以来最严重的干旱,导致运河通行船只受到吃水限制。

在干旱情况持续恶化的背景下,巴拿马运河管理局(ACP)宣布将进一步降低允许通过船只的最大吃水。

根据运河发言人Octavio Colindres介绍:从5月24日开始,新巴拿马型集装箱船被允许最大吃水44.5英尺(13.56米)。而5月30日后,吃水上限将再次降至44英尺。

而在此之前,新巴拿马型集装箱船的吃水限制是45英尺。据悉,2019年和2016年的干旱期间,巴拿马运河的吃水上限一度被降低至43英尺。有气象学家预测,今年夏天巴拿马运河的情况也许更加不乐观。也许在8月份我们将会看到巴拿马运河吃水上限再次被降至43英尺。

这一事态发展将给美东和美湾的航线带来压力。据专业人士透露,对巴拿马运河的吃水限制可能会迫使一艘10000TEU的集装箱船在通过运河之前卸载约4000TEU。

Lars Jensen说,“正如我们在疫情期间看到的那样,这可能会给班轮公司带来额外利润。我们只能等着瞧了。但主要的积极影响可能是货物必须长途运输,这将吸收部分总运力。”

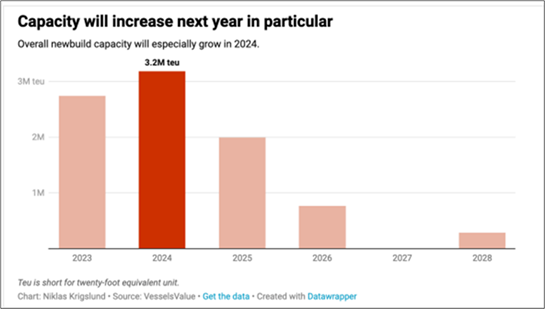

Xeneta首席分析师Peter Sand表示,在接下来的五年里,将交付1000多艘新船。它们的总舱位相当于现有船队的14.6%。仅在2023年和2024年,就将有800多艘集装箱新建船进入市场。全球经济放缓叠加大量新增运力将进一步增加运价的压力,但上述美西港口劳工谈判问题和巴拿马运河干旱可能会让班轮公司摆脱困境。

美西港口劳工谈判可能持续很长时间

分析师表示,最新的美西港口劳工谈判将持续多久还很难说。到今年7月,港口工人就已经一年没有达成劳动协议了,因此目前谈判到了一个关键点,各方被迫做出妥协,以避免罢工或停工。

Lars Jensen说:“人们不应该忽视工会的实力,尽管与一年前相比,他们的谈判地位有所削弱,当时他们肯定错过了一个黄金机会。他们控制着美西所有港口,如果发动罢工,货物就无法进入。那将是非常痛苦的。”

跨太平洋航线即期运价上升?

如果今年集运旺季与美西劳工冲突和巴拿马运河的干旱同时发生,跨太平洋航线现货运价将进一步上涨,并缓解集运市场运力过剩问题。不过,2023年6月9日,中国出口集装箱运价指数CCFI为921.48,比上周再跌1.0%。上海出口集装箱运价指数SCFI为979.85,下跌48.85点,跌幅为4.7%,把上周涨的全都跌回去了。

来源:航运界