在投标截止前三天,消息人士称,THE联盟成员赫伯罗特(Hapag-Lloyd)对收购韩国旗舰班轮公司韩新海运(HMM)表现出了兴趣,这使其成为第一家参与的外国实体。

随着HMM的两大股东韩国开发银行(KDB)和韩国产业银行(KOBC)委托三星证券正式开始招标,负责出售其合计持有的57.87%的HMM股份(包括可转换债券换股),并要求有兴趣的买家在8月21日之前投标。

据悉,就在投标结束前三天,赫伯罗特希望三星证券能提供招标说明书。

一位发言人表示:“赫伯罗特一直在研究进一步发展业务的各种可能。在这种情况下,我们还在探讨投资其他班轮业务是否可以在全球航运业中发挥更强大的作用。”

根据航运界网的跟踪报道,截至目前,至少有韩国LG集团旗下LX Pantos、SM集团、Harim集团、韩国东远(Dongwon)食品集团和Global Sae-a集团五家公司收到了三星证券的招标说明书。

在集运超级周期给HMM带来创纪录的收益后,两大股东决定让该公司摆脱国家支持。KDB和KOBC希望在11月前确定买家名单。市场人士预计韩国本土竞买人将不得不与私募股权投资基金合作,因为KDB和KOBC持有的HMM股票估值预计在38亿至76亿美元之间。

特别值得一提的是,截至6月30日,赫伯罗特持有73.8亿美元的现金和166亿美元的留存收益,使其在财务上比韩国本土竞购者拥有更强的实力。

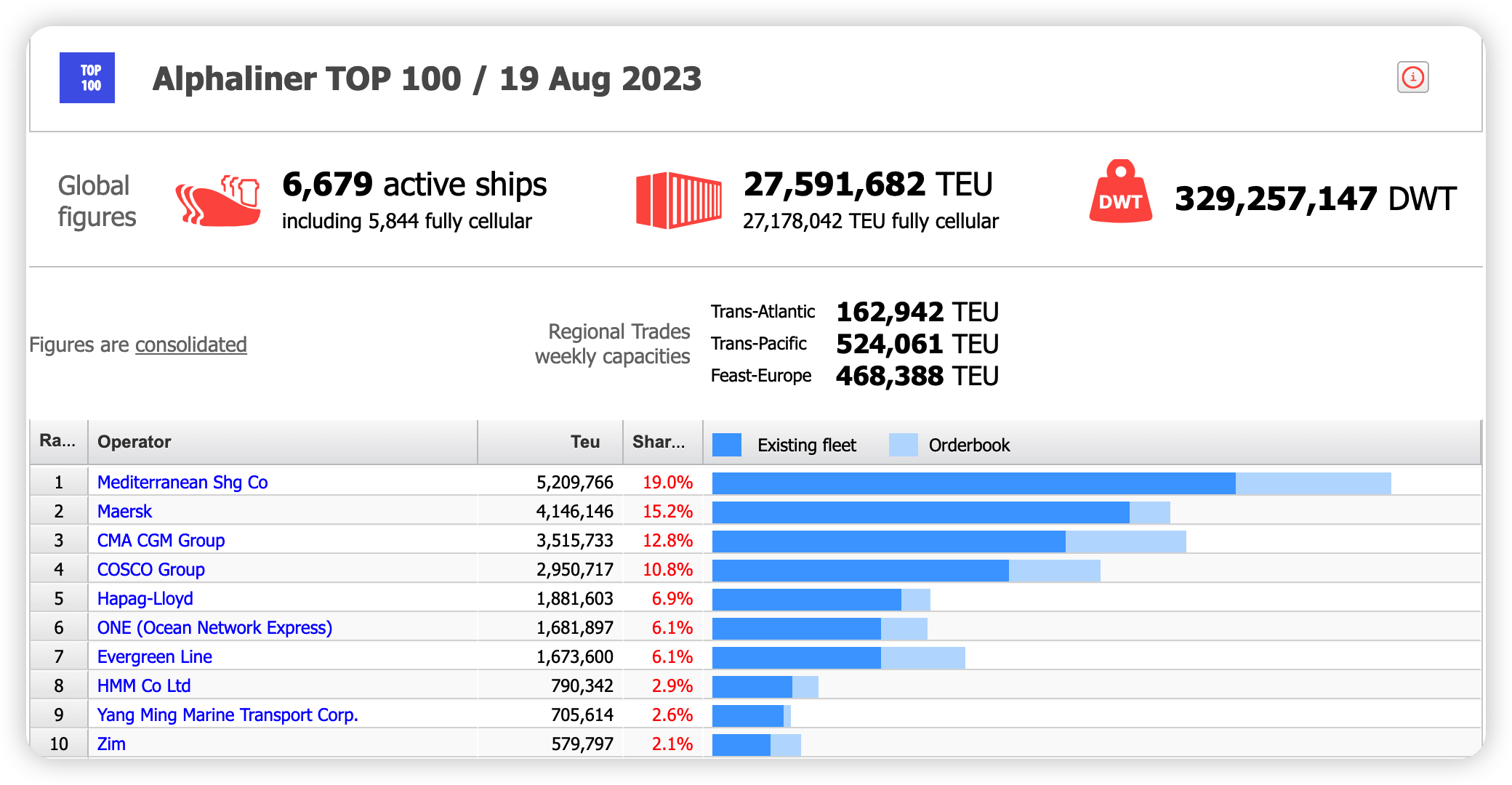

Xeneta的首席分析师Peter Sand表示,这家德国航运公司需要采取行动来保持其市场份额,因为其在订购新船和购买二手船方面没有像其竞争对手那样积极。

他说:“仅仅通过收购HMM,赫伯罗特可能无法‘赶上’中远海运集运,但如果不采取行动,则将很难避免被ONE和长荣海运超越。如果只是坐着等待,赫伯罗特可能会从第五位下滑到第七位。”

根据Alphaliner最新数据,在全球班轮公司运力100强中,排名第五的赫伯罗特运营188万TEU,有288640TEU的新造船订单。排名第6的ONE运营168万TEU,但订单量更大,为469768TEU。排名第7的长荣海运运营167万TEU,但订单量达到840650TEU。排名第8的HMM拥有790342TEU,订单量为265027TEU。赫伯罗特+HMM则可能意味着将拥有超过322万TEU的船队。

当然,根据韩国消息人士的说法,韩国政府和商界都“不愿意”将HMM出售给外国实体。

Linerlytica分析师Tan Hua Joo补充道:“将HMM出售给非韩国实体在政治上是不可行的,尤其是在它过去得到国家支持之后。”

不过,在过去的十多年内,赫伯罗特正是通过采取一系列的收购,从而巩固其全球排名第5的位置,比如在2014年收购南美轮船(CSAV),2017年收购阿拉伯联合航运(UASC),2021年收购尼罗河航运(NileDutch),以及在2022年收购DAL。

来源:航运在线